In today’s interconnected world, sending money across borders is as common as binge-watching your favourite series. Whether you’re supporting family down under, paying for services, or keeping a student afloat in Australia, knowing the ins and outs of international money transfers is crucial. So, how does one navigate this financial jungle and how to send money from India to Australia.

Key Takeaways

- Comparison is Key: Before making a transfer, compare rates, fees, and transfer times between services.

- Security First: Choose services with strong security measures to protect your money and personal information.

- Read the Fine Print: Be aware of hidden fees or exchange rate markups.

- Timing Matters: Transfer times can vary, so plan accordingly, especially for urgent transfers.

Understanding the Basics:

First, let’s talk turkey – or, in this case, Rupees and Australian Dollars. The international sending process has evolved significantly thanks to technology and the emergence of various payment gateways such as Wise (formerly TransferWise), PayPal, Western Union, and Instarem. These platforms have turned what used to be a thorough process into a few clicks or taps on a device.

How to Send Money from India to Australia: Choosing the Right Money Transfer Service

Wise: A Wise Choice Indeed

Wise, formerly known as TransferWise, has revolutionized the way we think about international money transfers with its transparent, cost-effective, and efficient services.

Unlike traditional banks, which often obscure their fees with unfavourable exchange rates, Wise prides itself on its straightforward fee structure. This structure includes a fixed fee alongside a variable fee proportional to the amount being transferred. This model ensures that customers are fully aware of the costs upfront, without any hidden surprises.

One of Wise’s standout features is its speed. The platform is designed to facilitate quick transfers, with many transactions being completed on the same day or even instantly. This efficiency is a significant advantage for users who need to send money urgently or prefer not to have their funds tied up in lengthy bank processes.

Security is another cornerstone of Wise’s service.

The platform employs robust measures to protect user data and funds. It includes two-factor authentication, which adds an extra layer of security by requiring a second form of verification before allowing access to an account or approving transactions. Additionally, Wise has a dedicated anti-fraud team that works tirelessly to monitor and prevent suspicious activity, ensuring users’ money is always safe.

Wise’s mobile app, which is acclaimed for its user-friendliness, further enhances the user experience. The app allows users to make and track transfers easily and offers features like rate alerts and the ability to repeat previous transfers, making the process as seamless as possible.

Wise’s commitment to transparency extends beyond its fee structure to its operations. The company regularly undergoes audits to verify its financial stability and the security of user funds, providing peace of mind that it is a trustworthy service. Moreover, Wise’s approach to handling user data with care and transparency aligns with global data protection standards, ensuring that personal information is handled responsibly.

Wise represents a modern solution to the age-old problem of costly and slow international money transfers. By prioritizing transparency, security, and user experience, Wise has become a popular choice for millions of users worldwide looking to move money across borders efficiently and affordably.

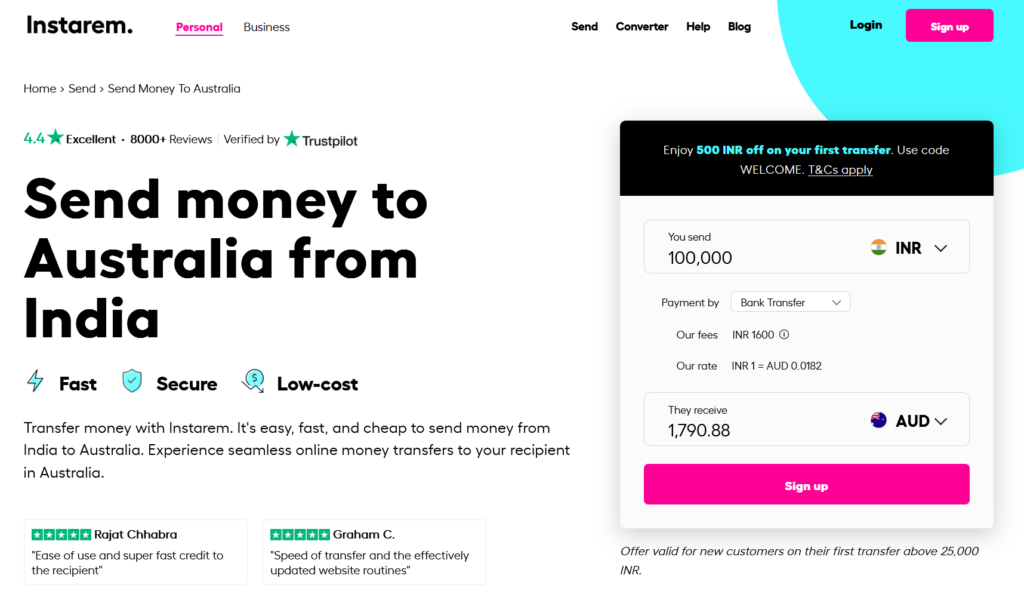

Instarem: The Cost-Effective Connector

In the digital age, sending money across borders has become a common necessity, whether it’s for supporting families, managing property, or conducting business. Among the myriad options available, Instarem stands out as a beacon for those seeking a blend of cost-effectiveness, speed, and reliability in their financial transactions from India to Australia.

Why Instarem?

Instarem has carved a niche in the competitive world of international money transfers with its transparent pricing, competitive exchange rates, and a user-friendly interface. Here’s a closer look at why Instarem is a go-to choice for many:

- Competitive Exchange Rates: Instarem prides itself on offering rates that are often closer to the market rate, or the ‘mid-market rate,’ which can result in significant savings over time

- Low and Transparent Fees: One of the most appreciated aspects of Instarem is its clear fee structure. Users are informed upfront about the charges, ensuring no unpleasant surprises. This transparency helps make informed decisions aligning with users’ financial planning.

- Speedy Transfers: The platform is known for its quick processing times. Depending on the specific transfer details, funds can be transferred to Australia in a matter of hours, making it an excellent choice for those needing to send money swiftly.

- Ease of Use: With Instarem, simplicity is key. The sign-up process is straightforward, requiring basic information and verification documents. Once set up, executing transfers is just a matter of a few clicks or taps on their mobile app, enhancing the convenience factor significantly.

- Customer Satisfaction: Reviews and testimonials from users often highlight the platform’s reliability and customer support efficiency. Instarem’s commitment to user satisfaction is evident through its responsive support team and the continuous improvement of its services based on user feedback.

Making the Most of Instarem

To start with Instarem, users must create an account and provide personal details and the necessary verification documents. Adding a recipient is a breeze, with the requirement for the recipient’s full name, address, and bank details. The platform’s app further simplifies the process, allowing users to easily manage their transfers, check historical exchange rates, and repeat transfers.

Instarem’s Global Reach

While focusing on the India-Australia corridor, Instarem’s services span over 60 countries, offering a wide range of currency pairings. This global reach ensures that whether you’re sending money to Australia or beyond, Instarem can cater to your needs.

Western Union: The Old Reliable

Western Union has established itself as a reliable and versatile option for international money transfers, earning its reputation as “The Old Reliable” in the money transfer industry. Known for its global reach and extensive network, Western Union allows individuals to send money from India to Australia with ease and security, catering to various needs, including personal, business, and educational expenses.

Direct Bank Transfers

One of Western Union’s core services is the ability to send money directly to bank accounts in Australia. This service is favoured for its convenience, allowing users to transfer funds from India to virtually any major bank in Australia. The process is straightforward, requiring the sender to provide their own banking details along with the recipient’s banking information, including the account number and the SWIFT/BIC code of the recipient’s bank.

Educational Payments

Western Union acknowledges the importance of education and supports this by offering specialized services for transferring money to pay for educational expenses directly to institutions in Australia. This feature is particularly beneficial for Indian students studying abroad or their families, enabling them to pay tuition fees, examination fees, and other related expenses without the hassle of intermediary banking procedures. The service ensures that funds are transferred securely and arrive in time to meet payment deadlines.

High Transfer Limits

Recognizing the diverse needs of its customers, Western Union provides high transfer limits, especially for educational payments. It is an essential feature for students or their families who need to make substantial payments for tuition and living expenses. The higher limits ensure that users can complete their transactions in fewer transfers, making it more convenient and potentially reducing the total cost of transfer fees.

Robust Tracking System

Western Union’s robust tracking system is a key feature that adds an extra layer of reassurance for users sending money abroad. Each transfer is given a unique tracking number (MTCN – Money Transfer Control Number), allowing both the sender and the recipient to track the money’s progress until it reaches its destination. This transparency is invaluable, especially for time-sensitive transactions such as educational payments, where knowing the funds’ status can provide peace of mind.

Hoping this helps:

In conclusion, sending money from India to Australia doesn’t have to be daunting. By choosing the right platform and staying informed about the process, you can ensure your money reaches its destination safely, quickly, and with minimal hassle. Just remember, like any good cricket match, success in money transfer comes down to choosing the right players and executing your strategy flawlessly.

Disclaimer: This article is for informational purposes only. We are not liable for any claims or decisions based on its content.

Frequently Asked Questions:

How much money can I send from India to Australia?

Limits vary by service. Western Union, for example, allows up to 15,000 AUD for educational purposes and 7,500 AUD for other transfers.

Are these money transfer services safe?

Yes, all recommended services use advanced security measures to protect your transactions.