In finance’s vast and ever-evolving world, understanding the fundamental concepts can sometimes feel like deciphering an ancient script. Among these essential concepts is the Compound Annual Growth Rate (CAGR), a term that might initially sound daunting but incredibly insightful once demystified. This guide aims to unravel the mystery of what is CAGR in finance, making it accessible and relatable to everyone, from budding investors to curious readers seeking to broaden their financial literacy.

What is CAGR in Finance?

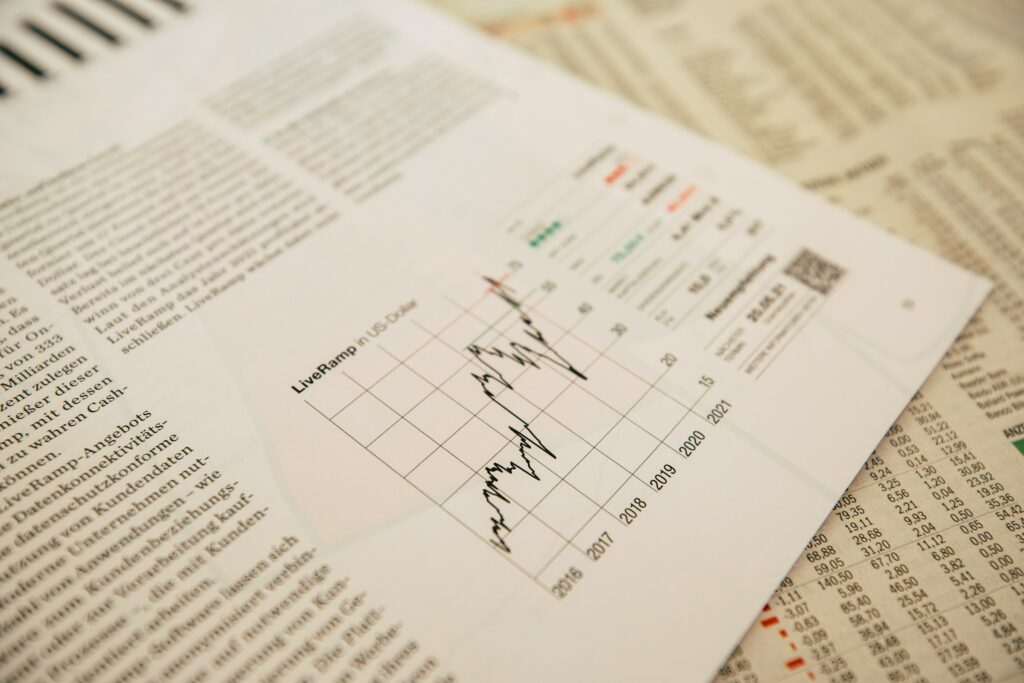

The Compound Annual Growth Rate (CAGR) is a measure used to calculate an investment’s average annual growth rate over a specified period, assuming the investment grows steadily. Unlike other metrics, CAGR smooths out the fluctuations that typically occur year-to-year in the real world, offering a clear, annualized rate of return.

It makes it especially useful for comparing the performance of different investments over the same period, providing a simple and effective way to understand how investments have grown or are expected to grow annually.

The Role of CAGR in Investment Strategy:

The Compound Annual Growth Rate (CAGR) plays a pivotal role in sculpting investment strategies across various spectrums of the financial world. Its significance stems from its ability to transform complex, volatile investment performance data into a clear, singular annual growth figure.

This clarity is invaluable for investors, financial advisors, and venture capitalists as they navigate the myriad investment options available in the market. In this exploration, we delve into the profound impact of CAGR on investment strategy, particularly focusing on retirement funds and venture capital investments.

CAGR: The Lighthouse for Retirement Fund Investments

Retirement funds are long-term investments designed to provide stability and growth over decades. Investors, from individuals planning their retirement to financial advisors managing pension funds, rely heavily on CAGR to make informed decisions. The reason is simple: CAGR offers a distilled view of an investment’s historical performance, smoothing out the annual fluctuations to present a clear picture of its growth potential.

- Long-term Stability and Growth: When assessing retirement funds, a strong CAGR over a prolonged period is a beacon of stability and potential growth. The fund has weathered the ups and downs of market cycles and provided consistent growth.

- Comparative Analysis: CAGR enables investors to compare the performance of different retirement funds on a like-for-like basis. This comparative analysis is crucial in selecting a fund that aligns with the investor’s risk tolerance and retirement goals.

- Informed Decision-Making: Armed with CAGR data, investors can better gauge the prospects of their retirement funds. While past performance does not guarantee future results, a consistent CAGR is often interpreted as a positive indicator.

CAGR in the World of Venture Capital

Venture capital is about investing in the future potential of start-ups and emerging companies. Here, CAGR is not just a tool; it’s a lens through which venture capitalists assess the growth trajectory of these ventures.

- Gauging Growth Potential: A start-up’s CAGR is a critical metric for venture capitalists. It provides a quantitative measure of the company’s growth over time, which, when combined with other qualitative assessments, helps make investment decisions.

- Risk Assessment: High CAGR figures can indicate a rapidly growing company but also come with increased risk. Venture capitalists use CAGR to balance the growth potential against the risk profile of the investment.

- Portfolio Performance: Venture capital firms often manage a portfolio of investments. CAGR is used to monitor the performance of these investments, identifying which ones are outperforming and which are underperforming. This information is critical in making strategic decisions about further investments or divestments.

The Strategic Advantage of Understanding CAGR

Understanding and effectively utilizing CAGR gives investors and venture capitalists a strategic edge. It allows for:

- Strategic Diversification: By comparing CAGR figures, investors can diversify their portfolios, balancing high-growth, high-risk investments with more stable, lower-growth options.

- Benchmarking Performance: CAGR provides a benchmark to measure the performance of investments against market indices or competitors, ensuring that investment strategies are meeting their objectives.

- Forward-Looking Strategy Development: While CAGR is a historical metric, it informs future strategy by highlighting growth trends and potential investment areas.

A Real-World Example to Illustrate CAGR

Let’s explore a hypothetical investment scenario that mirrors real-world possibilities to illustrate the concept of compound annual growth rate (CAGR) with a tangible example.

The story of investing $1,000 in a company like Acme Inc. and seeing it grow to $1,610 over five years provides a clear, accessible understanding of how CAGR operates and its significance in evaluating investment performance.

The Scenario:

- Initial Investment: $1,000 in Acme Inc. at the start of 2015.

- Ending Value: $1,610 at the end of 2020.

- Investment Duration: 5 years.

Calculating CAGR:

The formula to calculate the Compound Annual Growth Rate is as follows:

CAGR=(EVBV)1n−1CAGR=(BVEV)n1−1

Where:

- EVEV = Ending Value of the investment.

- BVBV = Beginning Value of the investment.

- nn = Number of years.

Plugging in the values from our Acme Inc. example:

CAGR=(16101000)15−1CAGR=(10001610)51−1

Let’s calculate this to find the CAGR.

Real-World Application:

While the Acme Inc. example is hypothetical, applying CAGR inaccurate investment decisions mirrors this process. Investors often face the challenge of comparing investments that have fluctuated widely in Value over time. Using CAGR, they can distil these complex patterns into a single, understandable figure that reflects the average annual growth rate, allowing for a straightforward comparison between investments or against benchmarks like the S&P 500.

Let’s calculate the CAGR for our example to demonstrate this concept concretely.

The Compound Annual Growth Rate (CAGR) for the investment in Acme Inc. over the 5 years is approximately 10.00% per year. This calculation cuts through the annual fluctuations and provides a smoothed average growth rate, offering a clear perspective on the investment’s performance.

This example underscores the utility of CAGR in real-world investment scenarios. It enables investors to gauge the efficiency and growth potential of their investments over time despite the inherent volatility in the market. By comparing the CAGR of various investments, individuals can make more informed decisions, aligning their portfolio with their financial goals and risk tolerance.

The Bottom Line:

In conclusion, the Compound Annual Growth Rate (CAGR) is not just a metric; it’s a storyteller, narrating the journey of investments through the tumultuous seas of the financial markets.

By understanding CAGR, investors can make more informed decisions, compare investment options more effectively, and ultimately, navigate towards their financial goals more confidently. Whether you’re a seasoned investor or just starting, grasping the essence of CAGR can significantly impact your financial strategy, turning complexities into opportunities for growth.

Frequently Asked Questions:

Can CAGR predict future performance?

While CAGR is a powerful historical analysis tool, it’s important to remember that past performance does not guarantee future results. CAGR does not account for future market volatility.

What makes CAGR different from other growth rates?

CAGR smooths over the volatility inherent in financial markets, providing a clear, annualized growth picture.

Is CAGR applicable to all types of investments?

CAGR is versatile and can be applied to a wide range of investments, including stocks, bonds, real estate, and mutual funds, making it a universal tool in finance.